does oklahoma tax inheritance

In this article we shall talk about the specifics of inheritance taxation for Oklahoma residents the difference between state and federal taxes and how to reduce the. Even though Oklahoma eliminated its inheritance tax in 2010 the Kentucky inheritance tax would be applicable on the transfer.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A person is permitted by the federal government to provide beneficiaries with 13000 a year or less without a tax being placed on the inheritance.

. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. Parman Easterday will explain the federal rules and advise you whether at your death or the death of a loved one from whom you are inheriting an estate tax return will need to be filed. States has abolished all inheritance taxes and estate taxes.

Only seven states have an inheritance tax. But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. There is no inheritance tax oklahoma.

That is because the State of Oklahoma abolished the Oklahoma estate tax over 7 years ago. In 2021 federal estate tax generally applies to assets over 117 million. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is. In some cases however there are still taxes that can be placed on a persons estate. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1.

Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies. Lets cut right to the chase. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

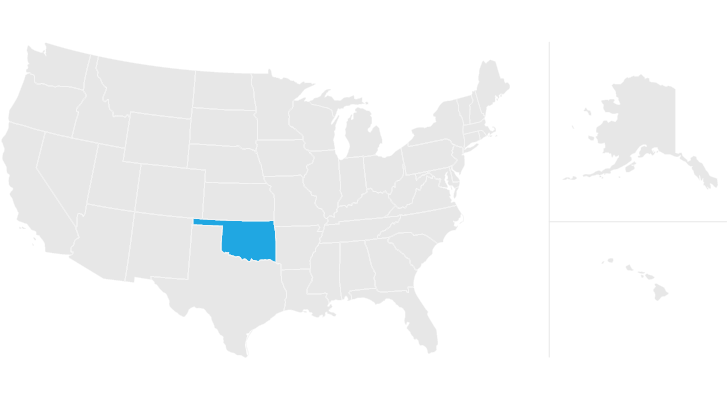

Does Oklahoma Have an Inheritance Tax or Estate Tax. Oklahoma does not have an inheritance tax. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law.

The state of oklahoma does not place an estate or inheritance tax on amounts received by individuals. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Estates and their executors are still required to file the following.

People were still concerned with. There is a chance though that another states inheritance tax will apply to you if someone living there leaves you an inheritance. They could find themselves subject to inheritance tax from another state if they receive money from an estate in that state.

There is no federal inheritance tax but there is a federal estate tax. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return Form 706. However there are several cases when an Oklahoma resident may become responsible for paying a certain tax due when it comes to inheritance.

But Oklahoma residents need to be careful. Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. There is no federal inheritance tax and only six states levy the tax.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. Strategies to Avoid or Reduce the Oklahoma Estate Tax. Inheritance Laws in Oklahoma.

Even though oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. If you inherit from somone who lived in one of the few states that has an inheritance tax--Iowa Kentucky Nebraska New Jersey Pennsylvannia and Maryland --you may get a tax bill from that state. Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

The amount that is taxed will be based on the. What Oklahoma Residents Need To Know About Federal Capital Gains Taxes. Fortunately trusts and wills are available to individuals who desire to pass larger.

Oklahoma like the majority of US. The state of Oklahoma lacks any gift tax laws but the federal government does have laws that apply to gifts by individuals. Oklahoma does not have an inheritance tax.

Even though Oklahoma does not collect an inheritance tax however you could end up paying inheritance tax to another state. Does Oklahoma Collect Estate or Inheritance Tax. However if you live in Oklahoma and you inherit valuable certain property from a state that does have an estate tax you should be aware that the estate may have to pay taxes on the inherited property.

Unlike an inheritance tax an estate tax is levied on the entire taxable portion of an estate before it is transferred to the heirs so there would be just one instance of taxation. This tax can be owed if a person who lives in one of the states with inheritance tax Iowa Kentucky Nebraska New Jersey or Pennsylvania gifts an asset to a beneficiary who lives in Oklahoma. Kentucky for instance has an inheritance tax that applies to all property in the state regardless of whether the person inheriting the property lives in the state.

Oklahoma has no inheritance tax either. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Oklahoma does not assess a gift tax or an inheritance tax.

Even after the state legislature passed the legislation there was still instability and uncertainty regarding both the Oklahoma estate tax return and federal estate taxes. How to Get a Tax ID Number for a Trust or Estate in Oklahoma. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax.

Heirs or beneficiaries do not have to pay an estate tax to Oklahoma nor do they have to worry about inheritance tax in Oklahoma. While the state of Oklahoma does not have any inheritance taxes an individual could still end up paying inheritance tax to another state. We no longer need to worry about Oklahoma inheritance tax.

Calculating Inheritance Tax Laws Com

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Oklahoma Inheritance Laws What You Should Know Smartasset

Holographic Wills In Wagoner County Giải Quyết Di Chuc

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Oklahoma Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Oklahoma Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Estate And Inheritance Taxes Itep

Here S Which States Collect Zero Estate Or Inheritance Taxes

State Estate And Inheritance Taxes Itep

Do I Need To Pay Inheritance Taxes Postic Bates P C

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

What To Do And Not Do With An Inheritance

Pin By Jeff Cayton R3homegroup Real On R3homegroup In 2021 Estate Tax Inheritance Tax Arizona Real Estate